stock market bubble meaning

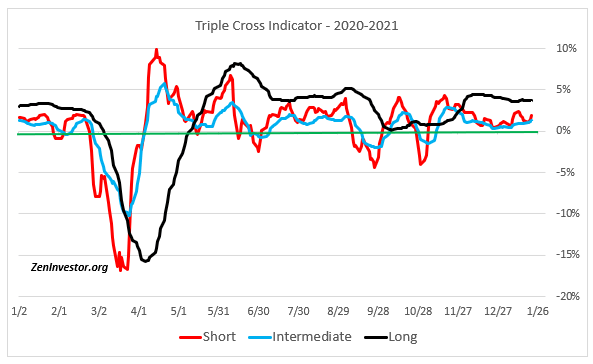

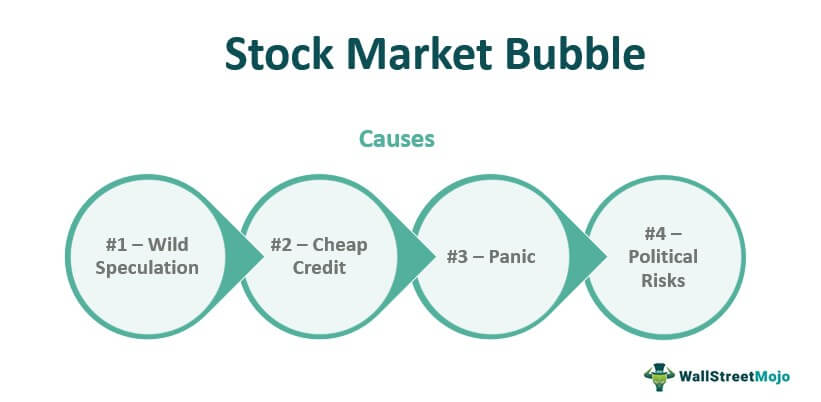

What you need to know about a stock market bubble. However even with those signs it can be difficult for analysts and traders to tell a bubble from a supported trend given that bubbles can happen on a variety.

What Is A Stock Market Bubble Forbes Advisor

Eventually the price will hit a level at which buyers are unwilling to continue.

. For investors on an individual level entering the market in the later stages of a bubble could mean painful losses. Stock screener for investors and traders financial visualizations. However it can be hard to ignore the herd mentality that behavioural finance theory believes is the cause of these bubbles.

The steep ascent is almost always followed by a sudden plunge. 5 Minute Takeaway. Small changes may temporarily halt the project but there may be some losses.

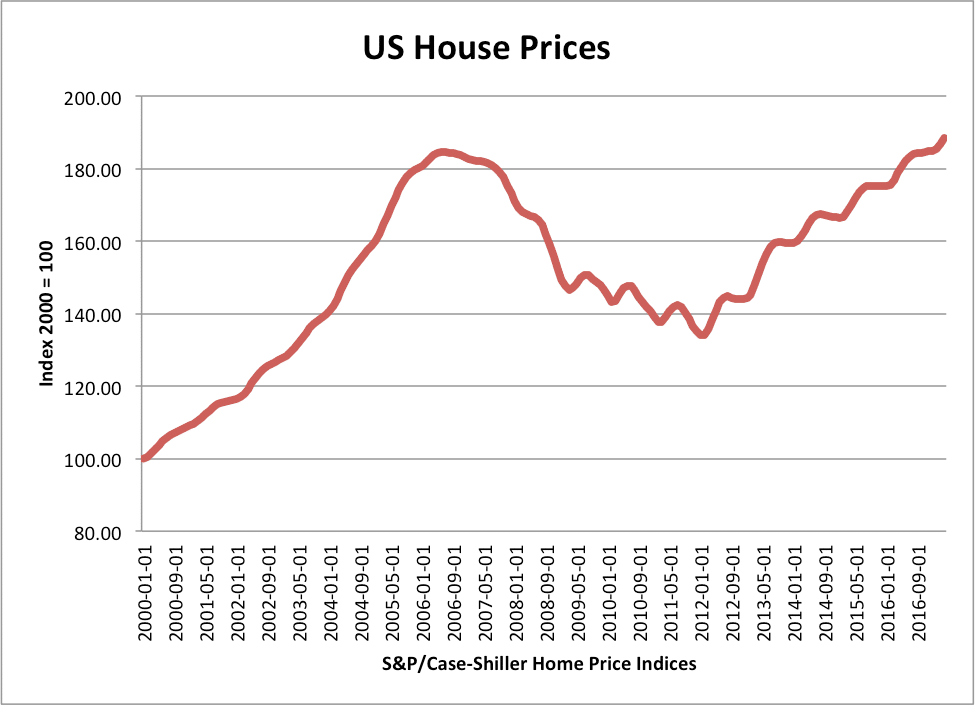

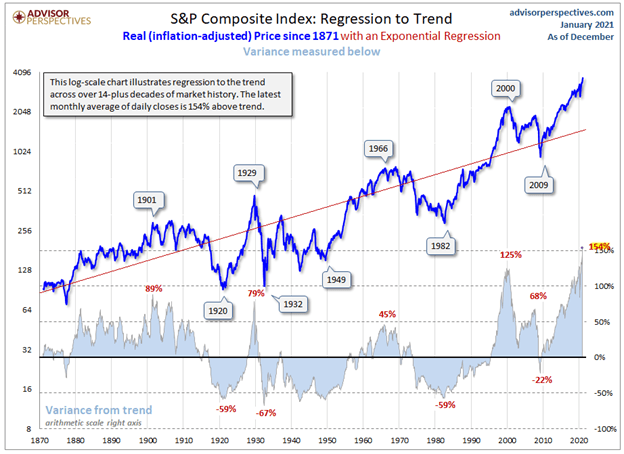

A stock market bubble is when share prices climb too far beyond fundamental values. Depending on your goals financial market bubbles can help or hurt you. The dotcom bubble of.

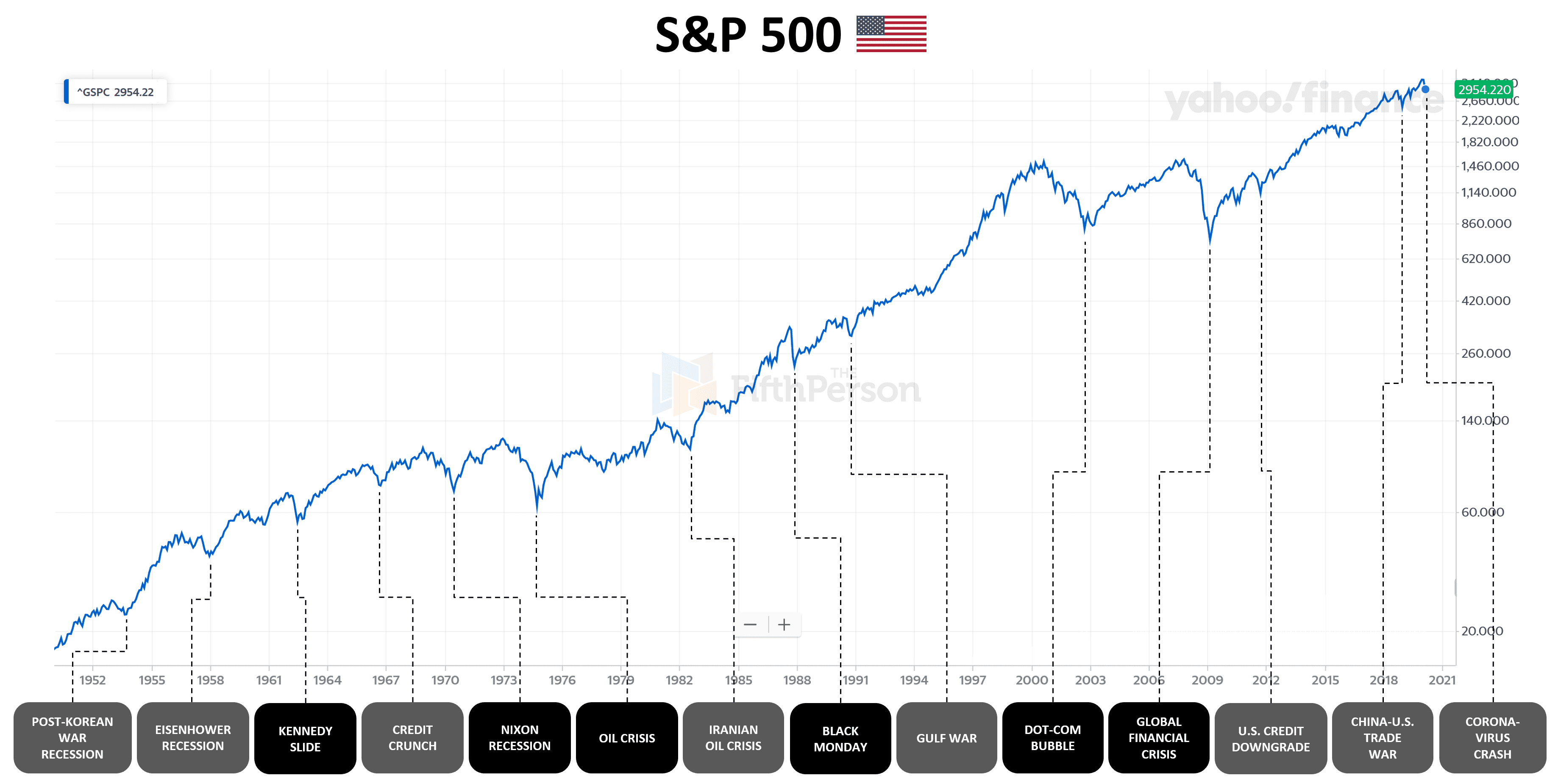

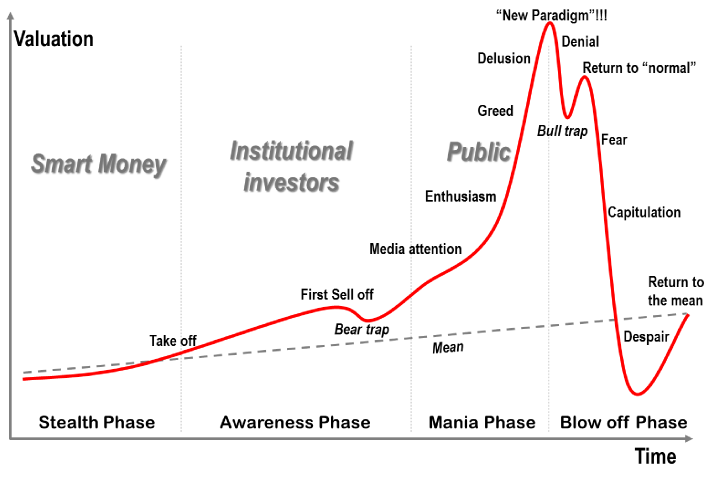

All stock market bubbles eventually burst meaning that stock prices suddenly and sharply decline. Jeremy Grantham co-founder of hedge fund GMO is warning that stocks could fall a lot further. A stock market bubblealso known as an asset bubble or a speculative bubbleis when prices for a stock or an asset rise exponentially over a.

The rise in price takes the value of the stock above and beyond its intrinsic or true value. While any number of events can lead to a bubble bursting stock market crashes often occur after. What Does a Bubble Mean in the Stock Market.

In the economic context a bubble is when the price for something a stock financial asset class or even the entire market is grossly overpriced compared to its fundamental value. Grantham added that as bubbles form they give us a ludicrously overstated view of our real wealth. A story has captured the markets imagination.

A stock market bubble can affect either the market as a whole or specific sectors such as within individual industries or geographic regions. A market bubble is a rapid rise in the price of stocks or other assets that is not justified by fundamentals and is followed by a sharp fall in prices once investor enthusiasm wanes. Stock market bubble is a term thats used when the market appears.

Stock market bubbles can be extremely hard to identify when they are happening but are easy to identify in retrospect. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behaviorBubbles occur not only in real-world markets with their inherent. What Does Stock Market Bubble Mean.

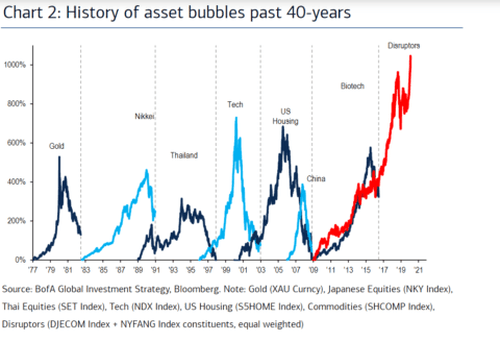

We have four different financial bubbles. Stock market bubble indicators can warn investors when a stocks price is too high. There may even be a stock market crash or an economic recession perhaps even depression following this kind of event.

Hype irrational buying and greed are all strong signs that a bubble is happening. A popular indicator is the price-to-earnings ratio PE. Bubble in an economic context generally refers to a situation where the price for somethingan individual stock a financial asset or even an entire sector market or asset classexceeds.

A compelling story is one of the best frameworks for creating a stock bubble. Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

Stock Market Bubble. As an investor in shares the ability to recognise when a stock market bubble is developing is crucial to the performance of your portfolio. A stock market bubble is the name investors give to an event where specific assets are overvalued in the market.

Are we in a stock market bubble. Stock market bubbles market bubbles credit bubbles and commodity bubbles. The bursting of an asset bubble is as expected to result in a variety of outcomes.

A stock market bubble is a period of growth in stock prices followed by a fall. A bubble is defined as a period when prices rise rapidly outpacing the true worth or intrinsic value of an asset market sector or an entire industry such as. Learn how a financial bubble.

A stock market bubble also known as an asset or speculative bubble is a market movement consisting of a rapid exponential increase in share prices over a period of time. When the price of stocks surge and demand reaches a fever pitch investors may wonder. A combination of forces such as rapidly increasingly stock prices market confidence that the companies have strong potential of churning future profits individual speculation at every corner and a widely available investment capital create an environment which inflates the stock prices and gives.

Stock market bubbles are notoriously difficult to spot but are famous for potentially causing large-scale consequences such as market crashes and recessions. They typically occur when investors overvalue stocks either misjudging the value of the underlying companies or trading based on criteria unrelated to that value. Investors and analysts value stocks based on different measurements.

But misdiagnosing a stock market bubble or exiting from positions too.

What Is A Stock Market Bubble The Motley Fool

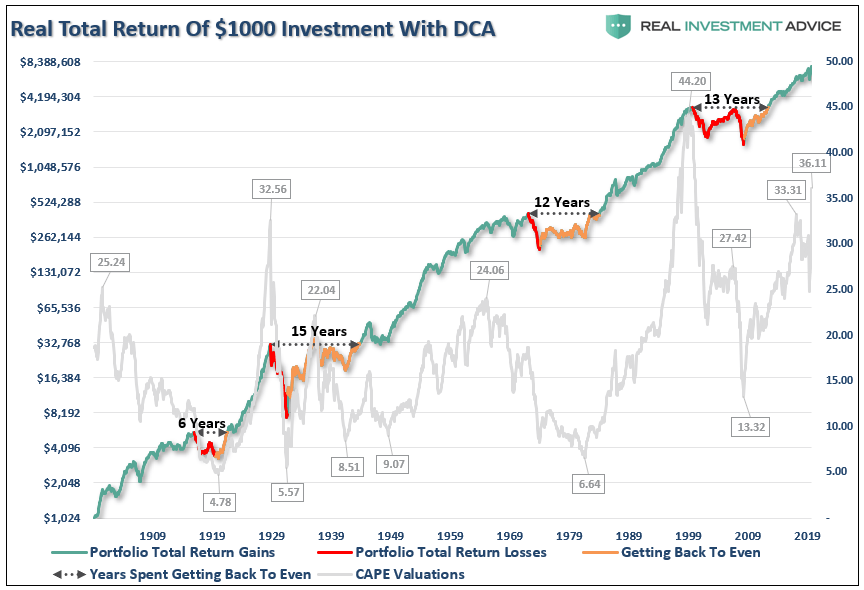

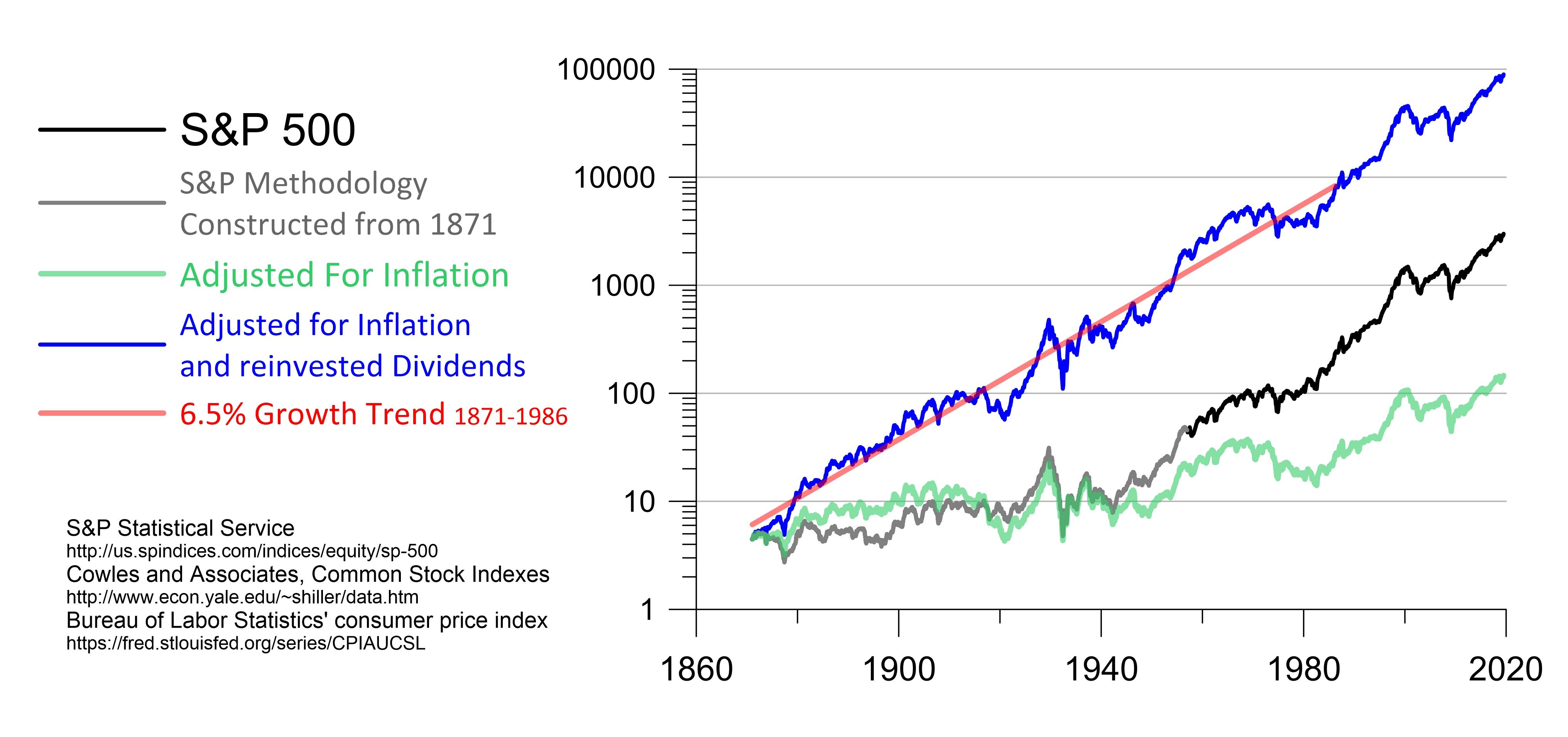

4 Reasons Why The Stock Market Keeps Rising Over The Long Term

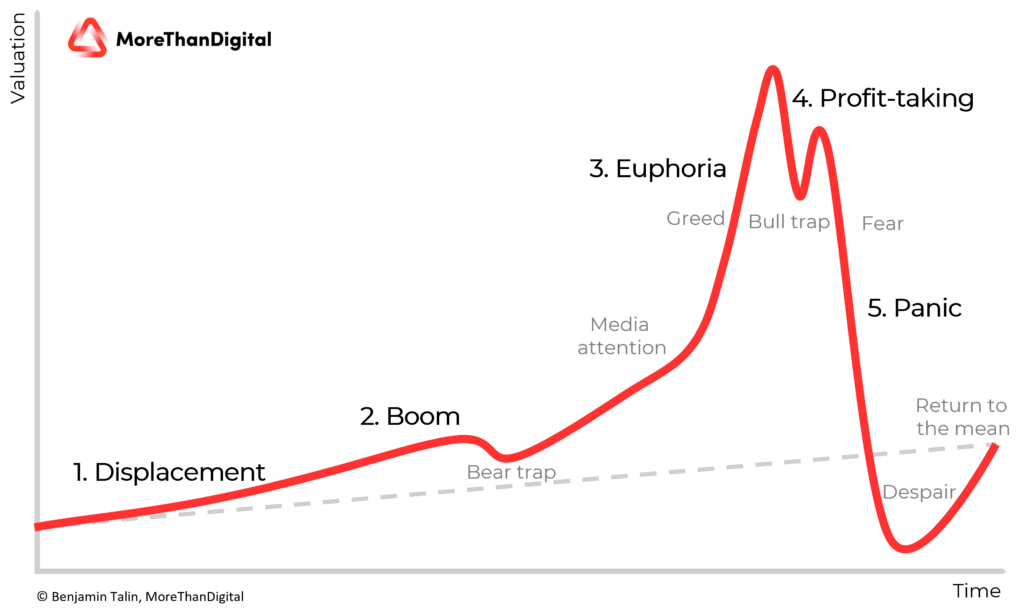

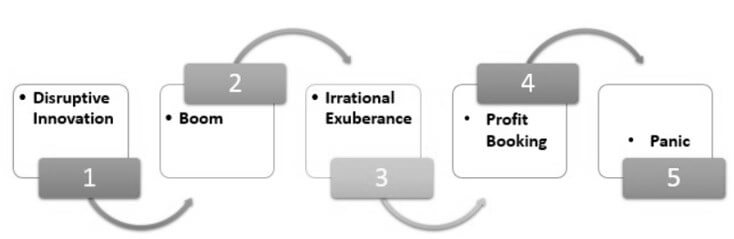

Economic Bubble Definition Types And 5 Stages Of Financial Bubbles Morethandigital

Stock Market Bubble Definition Example How To Check

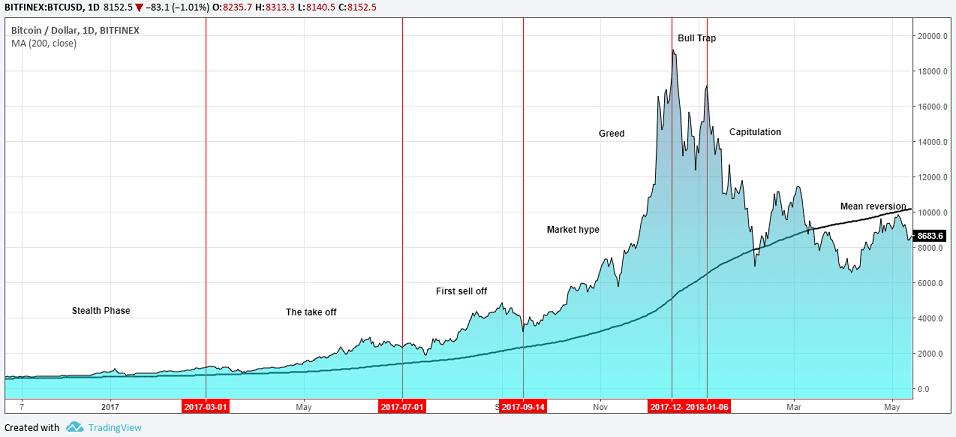

See How To Identify And Trade Stock Market Bubbles Tradingsim

If Covid 19 Won T Pop The Stock Market Bubble What Will Nasdaq

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

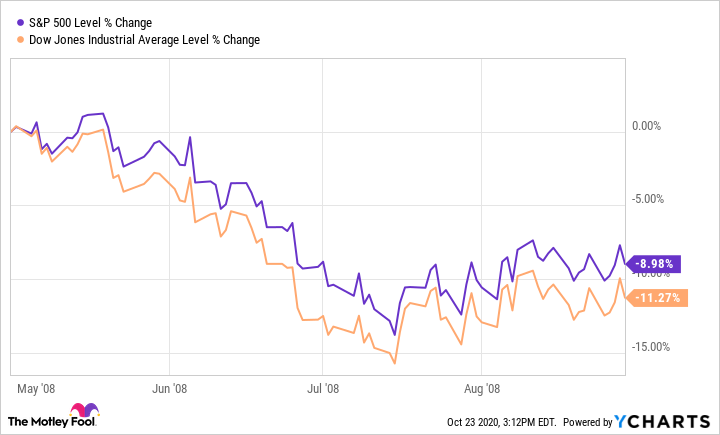

What Are Stock Market Corrections The Motley Fool

We Are Now Officially In A Stock Market Bubble Seeking Alpha

Stock Market Bubble Definition Example How To Check

Are We In A Stock Market Bubble Right Now Stopsaving Com

The Stock Market Bubble Starts To Burst Chemicals And The Economy

Stock Market Super Bubble And The Demographic Trigger Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_INV_final_Irrational_Exuberance_Jan_2021-01-45e4d7c38e1f47f290063b49bf234f9a.jpg)

Irrational Exuberance Definition

Investors Can T Ignore This Clear Sign Of A Stock Market Bubble Seeking Alpha

We Are Now Officially In A Stock Market Bubble Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_INV_final-Tech-Bubble_Feb_2021-01-f60580df62c24a79830dfb739e76af50.jpg)